Canadian Investor Protection Fund

The Segregated Funds

Resources and Liquidity

CIPF maintains two segregated funds designed to provide coverage to eligible customers of CIRO Members: an Investment Dealer Fund and a Mutual Fund Dealer Fund. CIPF is funded by its member firms.

The Investment Dealer Fund is available to satisfy potential claims for coverage by customers of CIRO Members duly registered under Canadian securities legislation in the category of “investment dealer” or in the categories of both “investment dealer” and “mutual fund dealer”. The Mutual Fund Dealer Fund is available to satisfy potential claims for coverage by customers of CIRO Members duly registered under Canadian securities legislation in the category of “mutual fund dealer” (other than customers served by the office of such a CIRO Member located in Québec who will not be afforded coverage by the Mutual Fund Dealer Fund).

Only the Investment Dealer Fund is available to satisfy claims for coverage under this Policy by eligible customers of “investment dealers” or dually registered “investment dealers” and “mutual fund dealers”, and in no event will claims made by customers of an insolvent firm registered as a “mutual fund dealer” be satisfied from the Investment Dealer Fund. Similarly, only the Mutual Fund Dealer Fund is available to satisfy claims for coverage under this Policy by eligible customers of firms registered as “mutual fund dealers”, and in no event will claims made by customers of an insolvent “investment dealer” or dually registered “investment dealer” and “mutual fund dealer” be satisfied from the Mutual Fund Dealer Fund.

The CIPF Board sets the size of the two segregated funds to be maintained for the client assets it protects. It also sets member firm assessments and the policy on how monies in the two segregated funds are to be invested.

Investment Dealer Fund

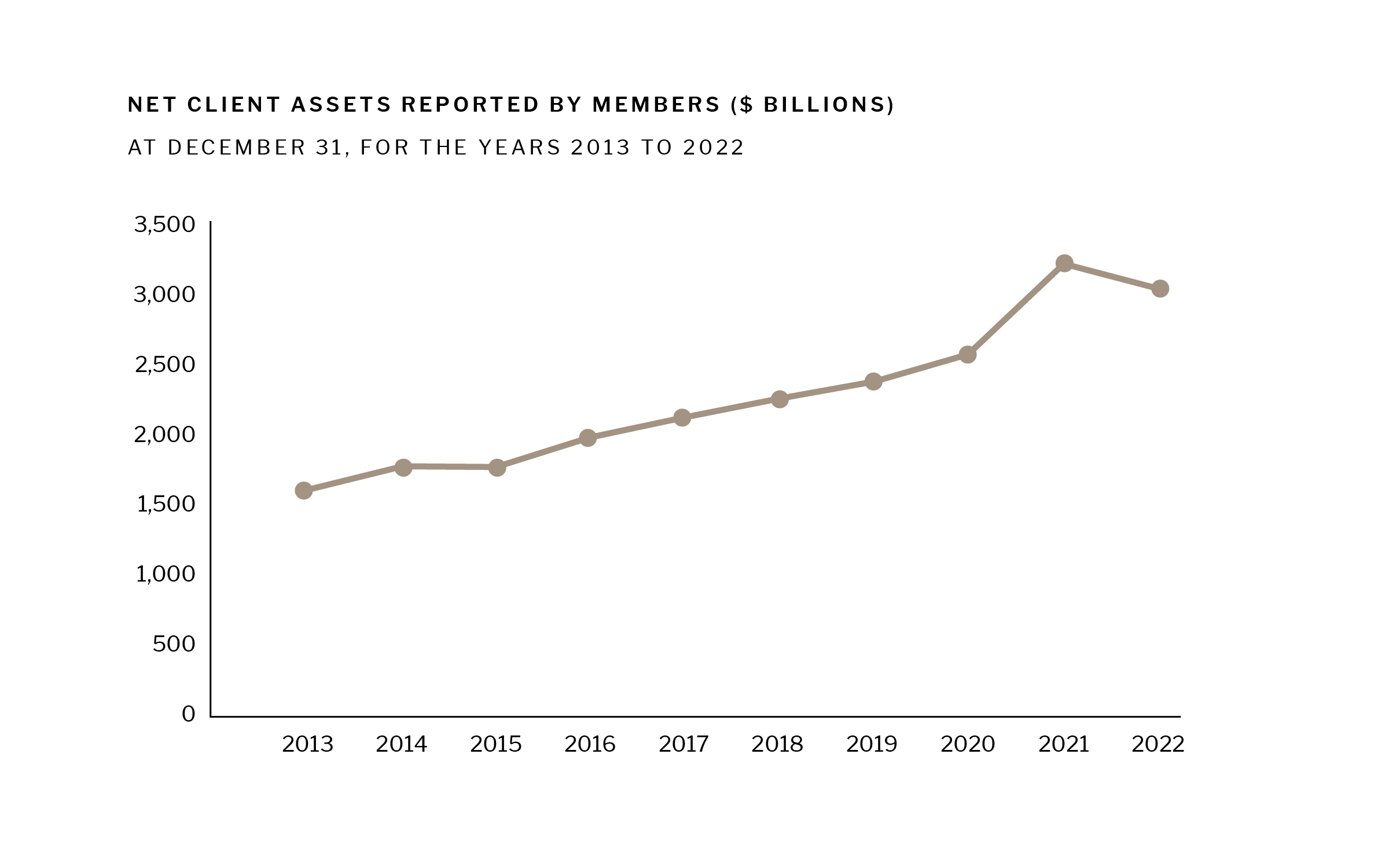

Investment Dealer Fund size: The Board uses a model to assist it in setting the Investment Dealer Fund size. The model weights client assets for the relative risk of the Investment Dealer member firm that is responsible to the customer for those assets. Investment Dealer member firms with strong internal controls, profitability and capital will have lower risk scores.

Investment Dealer Assessments: The model is also used to determine the amount of the quarterly portion of the annually approved Target Assessment that is allocated to each Investment Dealer member firm. All other things being equal, Investment Dealer member firms with either relatively more client assets, or a relatively higher credit-risk rating, will pay a proportionately larger percentage of the approved Target Assessment. CIPF also levies additional assessments as follows: (i) a Capital Deficiency assessment on Investment Dealer member firms that have not complied with the industry rule that requires them to maintain positive capital at all times; (ii) An Asset Location Assessment to those member firms whose business model allows for the custody of assets at locations that are potentially more encumbered than assets in a segregated account at a Canadian depository.

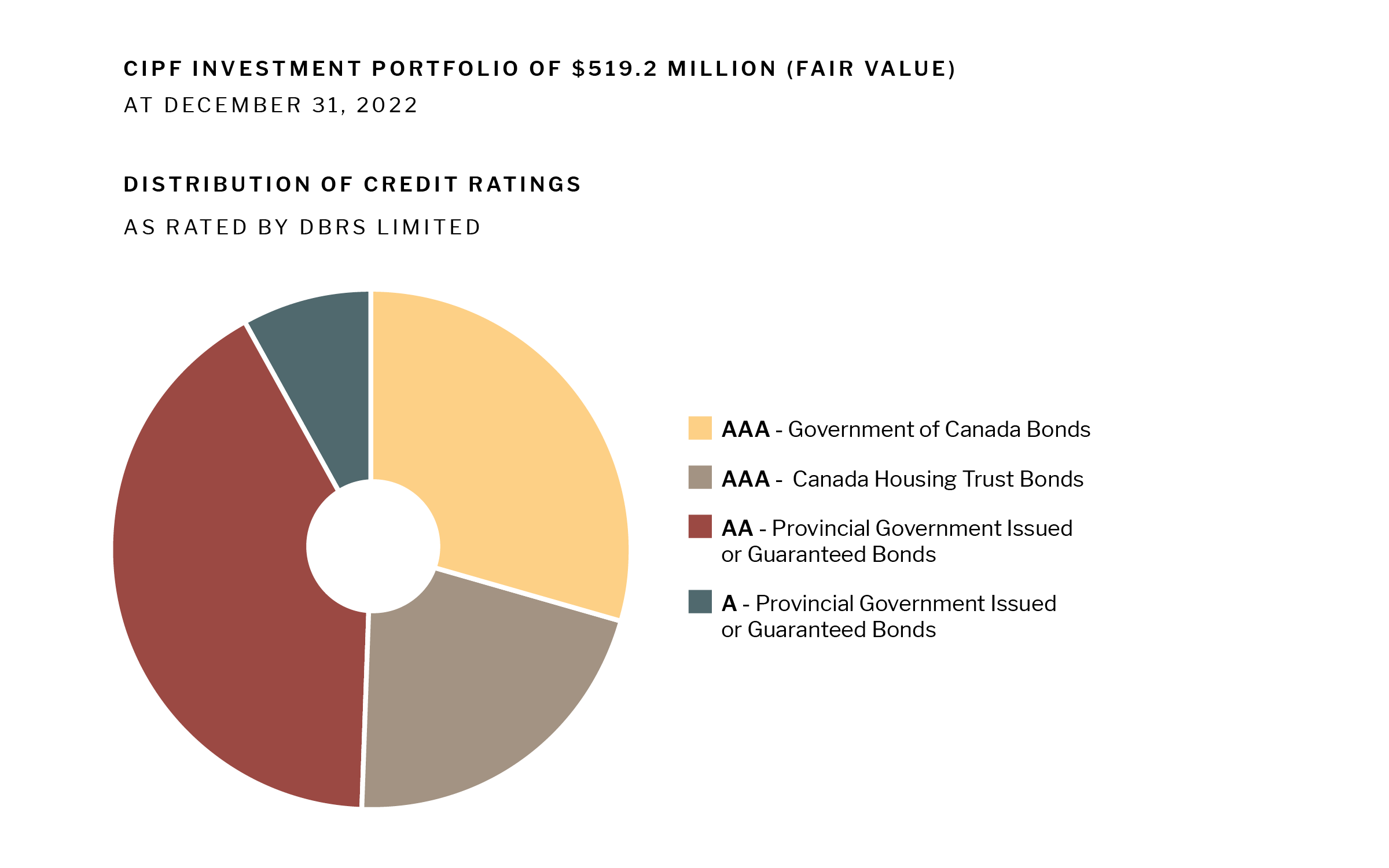

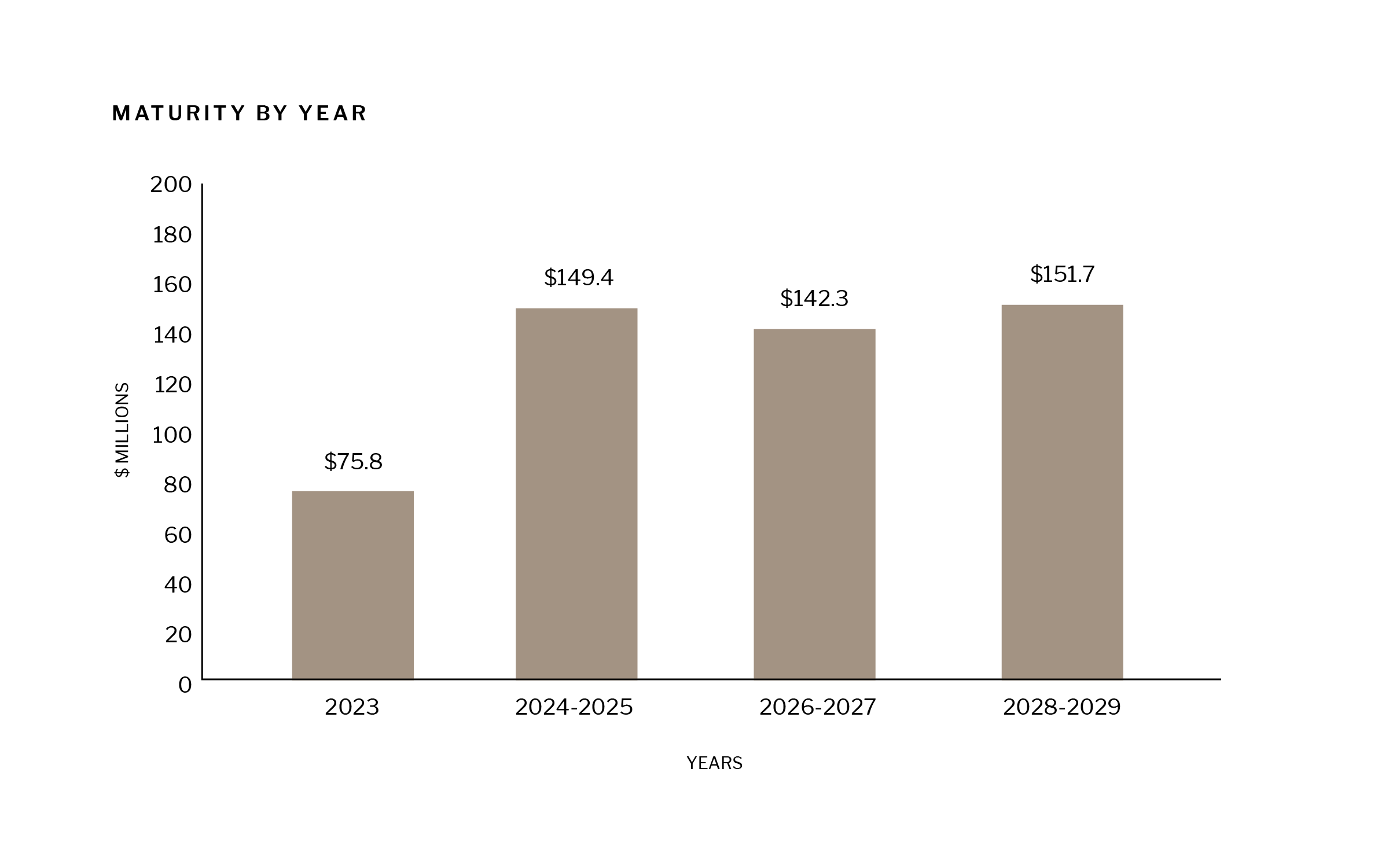

Investment Dealer Investment Policy: All investments must be in highly liquid Canadian or provincial government guaranteed debt obligations that mature over a 7-year period.

Investment Dealer Other resources

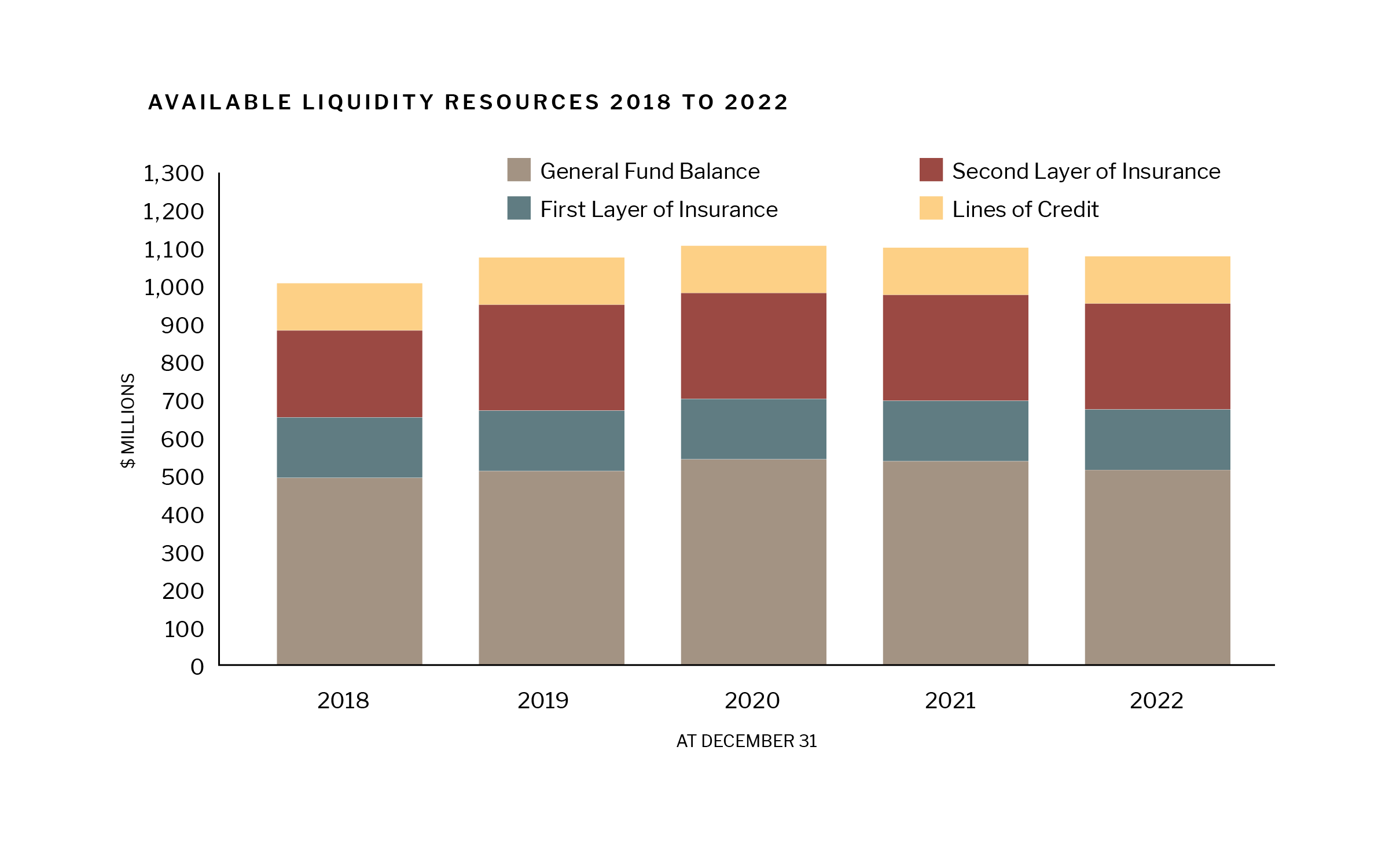

For liquidity purposes CIPF has committed lines of credit provided by two Canadian chartered banks totalling $125 million to be used in the event of a claim against the Investment Dealer Fund. The lines of credit are guaranteed by CIRO.

CIPF has also arranged insurance in the amount of $160 million in the annual aggregate, in respect of losses to be paid from the Investment Dealer Fund in excess of $200 million, and a second layer of insurance in the amount of $280 million, in respect of losses to be paid in excess of $360 million in the event of an Investment Dealer member firm insolvency.

Mutual Fund Dealer Fund

Mutual Fund Dealer Fund size: The Board has set a target of $50 million for the Mutual Fund Dealer Fund.

Mutual Fund Dealer Fund Assessments: The Board sets the annual assessment of Mutual Fund Dealer member firms to cover operating costs incurred by or allocated to the Mutual Fund Dealer Fund.

Mutual Fund Dealer Fund Investment Policy: Investments must be in highly liquid Canadian or provincial government guaranteed debt obligations that mature over a 10-year period except for up to 10% of the portfolio which may be invested in certain corporate fixed income instruments.

Mutual Fund Dealer Fund Other resources

For liquidity purposes, CIPF has a $30 million committed line of credit provided by a Canadian chartered bank which may be used in the event of a claim against the Mutual Fund Dealer Fund. The line of credit is guaranteed by the CIRO.

CIPF has also arranged insurance in the amount of $20 million in the annual aggregate, in respect of losses to be paid from the Mutual Fund Dealer Fund in excess of $30 million, and a second layer of insurance in the amount of $20 million, in respect of losses to be paid in excess of $50 million in the event of a Mutual Fund Dealer member firm insolvency.