Canadian Investor Protection Fund

Policies and Guidelines

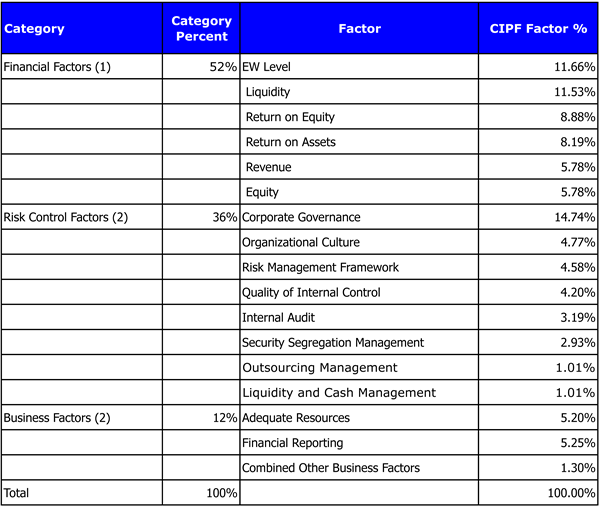

CIPF Assessment Policy

As of January 1, 2023 and amended April 1, 2024

As of January 1, 2023 and amended August 25, 2023

CIPF Assessment Appeal Procedures

As of January 1, 2023 and amended April 1, 2024

As of January 1, 2023 and amended August 25, 2023

As of January 1, 2023 and amended August 25, 2023